The relative decline of the US defense technology leadership is synchronized with the decline of its rare earth capabilities.

This is an astonishing story. America's long-failed economic and national security policies, while stifling the economy, have also led it to lag behind China in many next-generation weapons systems.

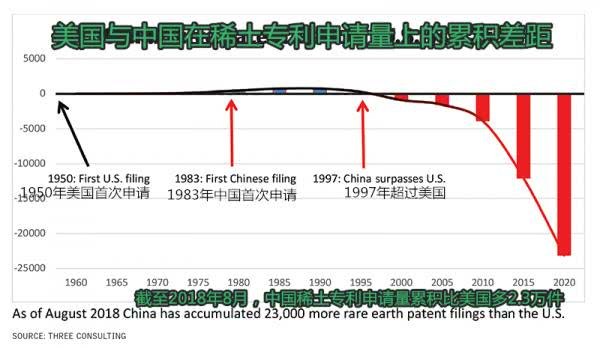

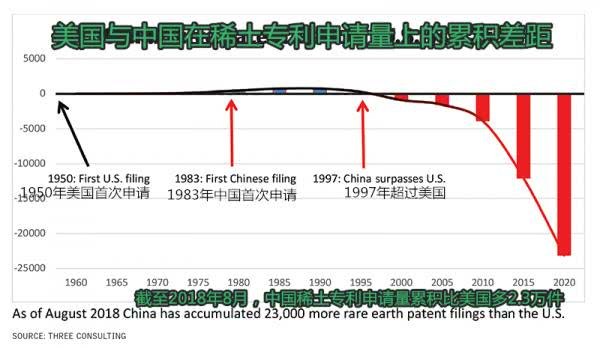

At the same time, China's progress is mainly due to its extraordinary efforts in rare earth resources production, refining, materials science, metallurgy, intellectual property rights, R&D and commercial and defense applications to achieve world leadership. Rare earths include 17 elements on the periodic table of elements, which are key components of most modern technologies and weapon systems.

The supply chain of rare earth in the United States was damaged for the first time in 1980. The amendment of relevant regulations by the US Nuclear Regulatory Commission and IAEA - "Part 40: Domestic Licensing of Source Material" - inadvertently led to the overall transfer of the US rare earth industry to China.

Until then, heavy rare earths came from thorium-containing by-products of commodities such as iron ore, titanium, zircon or phosphate rock. At that time, mining companies could extract rare earth by-products and earn a little extra profit. But then anything containing thorium was regarded as a potential source of nuclear fuel and highly regulated, and the business was cut off. For cost and liability reasons, these mining companies classify rare earth resources as tailings when waste is buried.

This has a far-reaching impact on rare earth production in all countries that comply with the regulations of the U.S. Nuclear Regulatory Commission or the International Atomic Energy Agency. China is an observer of the International Atomic Energy Agency, but not a party to it.

Today, the gap between China and the United States continues, partly because the Pentagon, government agencies and the financial and mining industries measure rare earth extraction at the level of mining and oxide production. Hundreds of rare earth mining projects have been launched outside China, mistakenly giving the impression that Western dependence on China's rare earths is declining. However, most projects eventually failed.

Of the more than 400 rare earth start-ups listed in 2012, fewer than five have entered the stage of production, and only two have reached a certain output. One of them has revived after bankruptcy under China's financing, while the other has lost its operating license in a short period of time.

In the meantime, China has taken important equity and debt positions from many projects that have failed or are on the verge of failure. Once the project starts production, China will take control.

Moreover, the inclusion of rare earth mining and purified oxides only in the report would distort government policy decisions, as these materials could hardly be applied to technology or national defence until they were refined into metals. Only China has refining capacity. In fact, all rare earth mines outside China send concentrates or high-value oxides to China for processing into rare earth metals, alloys, magnets and other high-value materials.

The United States is too focused on rare earth mining rather than the entire supply chain, which has a negative impact on its national security and economic security, because all defense and technological applications start with rare earth base metals or other post-oxides, rather than newly mined ores or oxides. China has locked in access to rare earth metals, alloys, magnets and most post-oxides worldwide.

In February 2016, the U.S. Government Accountability Bureau released a report entitled Rare Earth Materials: Developing Comprehensive Approach Can Help DoD Better Manage National Security Risks in the Supply Chain"("Rare Earth Materials: Developing a Comprehensive Approach Can Help DoD Better Manage National Security Risks in the Supply Chain"). According to its estimates, the United States may need 15 years to rebuild its domestic rare earth supply chain.

American policymakers hardly understand the complexity of these issues. If they were told that China would shut down all other countries'automobiles, computers, smartphones and aircraft assembly lines if it chose to ban these materials, they would be stunned. The same could happen to all rare earth-dependent weapons systems in the United States and NATO. These supply chains can be cut off. Therefore, Western military procurement is under the control of China.

Nevertheless, neither the U.S. government report nor the assessment made the above conclusion, because they used rare earth mining and oxide production statistics to replace all rare earth materials including metals, alloys, magnets, garnet and other post-oxides. In the event of a crisis, the United States lacks emergency preparedness.

The aforementioned materials are hardly in reserve at the Defense Logistics Agency of the United States. The U.S. government sold all its strategic rare earth reserves between 1994 and 1998. The Defense Logistics Agency currently has only a small strategic reserve of rare earth oxides and dysprosium metals. This form of material cannot be used directly by the U.S. defense industry. According to the report of the Government Accountability Bureau, these materials need to be processed in China's supply chain before they can be used.

All rare earth metals, alloys and magnets used by U.S. defense contractors and technology companies can be traced back to China: they are either directly from China or indirectly purchased from Japan or imported from U.S. alloy and magnet manufacturers.

In July 2014, the U.S. Defense Department's Inspector General reported that "Procedures to Ensure Sufficient Rare Earth Elements for the Defense Industry Base Need Improvement" pointed out that the Pentagon could not effectively monitor rare earth investment at the spare parts and subcontractor level. Enter. To make matters worse, it is clear from the report that the United States